Portfolio stress-testing higher-for-longer rates

Modeling the impact of higher inflation and monetary policy expectations on a multi-asset portfolio

Christoph Schon,

EMEA Applied Research, SimCorp

Persistently high consumer price growth has repeatedly caught market participants by surprise this year, prompting traders to price out 125 basis points of monetary easing from the Federal Reserve by the end of the year. And, even the one rate cut still implied by short-term interest-rate (STIR) futures could be seen as increasingly optimistic, should there be any more upward inflation shocks. Equity markets have so far been largely unfazed, but the steep correction after the March inflation report showed that they too are vulnerable. In this article, we explore the potential impact of a more severe upward revision in inflation and monetary policy expectations (‘higher-for-longer’) on various asset classes, using the portfolio stress testing capabilities of Axioma Risk.

Rate setters and traders are likely to up their projections even more

There is no arguing that inflation in the United States has eased significantly from its 9% peak in the headline rate two years ago. Core inflation, especially, had been on a steady downward trajectory, and month-over-month changes in the second half of 2023 were all consistent with an annual growth rate of 2%. STIR markets were therefore confident at the start of this year that the Fed would have cut its target rate by at least 50 basis points by June and potentially 1.5 percentage points by year end. However, after having been wrongfooted three times in a row, bond traders have now abandoned any hope of a move in June and the projected federal funds rate for December is only 25 basis points lower than the current level.

Fed Chair Jerome Powell has so far repeatedly played down speculations of a further tightening of monetary conditions, stressing instead that the current restrictive level of interest rates would simply have to be maintained for longer than originally anticipated. The latest Federal Open Market Committee (FOMC) economic projections from March indicated that nine of its 19 members expected the federal funds target to be 75 basis points lower by year end, with one rate setter arguing for a full percentage point and two participants anticipating no change. However, these predictions are now almost three months out of date, and the 2.6% growth rate in core personal consumption expenditure — the Fed’s preferred measure of inflation — predicted for the end of 2024 seems increasingly optimistic given the strong monthly changes in consumer prices reported since then.

It is therefore likely that these staff projections — both for inflation and interest rates — will once again be revised upwards at the next FOMC meeting on June 12, which also happens to be the day on which the inflation data for May will be released. Any upward surprise in any of these numbers is likely to invoke a strong market reaction.

The following case study shows how the portfolio stress testing capabilities of Axioma Risk can be used to simulate the impact of yet another revision in monetary policy and inflation expectations on a USD-denominated balanced portfolio.

How to construct the portfolio stress test

In a transitive stress test, one shocks a small number of variables and then uses historical correlations to calculate the betas of the pricing factors that drive the returns of the securities in the portfolio to those variables. There are two decisions that need to be made: (1) which variables to shock and by how much, and (2) which historical period to choose for calibrating the covariances and betas.

In this analysis, we were looking to model a scenario in which rising inflation might prevent the Federal Reserve from lowering interest rates before the end of the year. The market variable that best represented these expectations was the CME December 30-day federal funds future (FFZ24), currently trading just below 95, which implied a rate of slightly above 5% (100 minus price). We assumed that its price would fall to the value of the current June contract trading at 94.67, which is equivalent to the current effective rate of 5.33%. We further presumed that this would be accompanied by a rise in long-term inflation expectations — represented by the 10-year US Treasury breakeven rate — and the same-maturity nominal yield, which is usually strongly correlated with the former.

Having settled the question of the variable shocks, we now needed to choose a suitable calibration period. Ideally, this would be a time in which rising interest rates coincided with a significant correction in the stock market. This was exactly what happened between the end of July and late October 2023, when the expectation that the Fed may keep rates at higher levels for longer than previously anticipated propelled long-term Treasury yields to 16-year highs of around 5%, while share prices plummeted by around 10%. At the same time, the 10-year breakeven inflation rate climbed to 2.4%.

Portfolio stress testing for higher inflation and interest rates

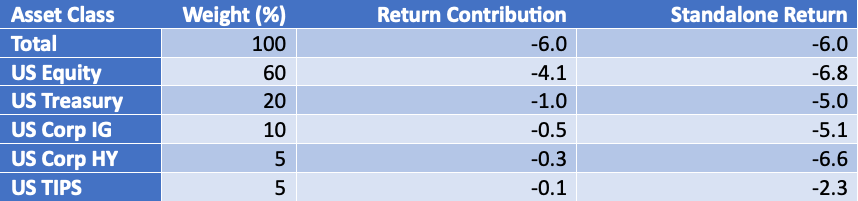

The table in Figure 1 shows the simulated returns of the major asset classes within the balanced portfolio for a 25-basis point upward revision in year-end rates expectations, a 50-basis point widening in the 10-year breakeven rate and a one-percentage point rise in the nominal 10-year Treasury yield. The standalone returns of the bond categories in the last column were normalized to a duration of six years in order to make them comparable.

Figure 1. Stimulated portfolio returns and contributions by asset class

Source: Axioma Risk

All asset categories in the portfolio are likely to suffer losses — at least at the aggregate level — as would be expected in an environment where investors are concerned about soaring inflation and a more restrictive monetary policy response. Investment grade corporate bonds show similar returns to US Treasury securities, as the returns of both are driven primarily by changes in risk-free rates, with little impact from widening credit spreads. However, the effect of the latter is more noticeable in the high yield bucket, where risk premia are much more (negatively) correlated with share prices. Treasury inflation-protected securities (TIPS), on the other hand, can be expected to get some relief from the higher breakeven rates.

Sectors with pricing power could offer some protection

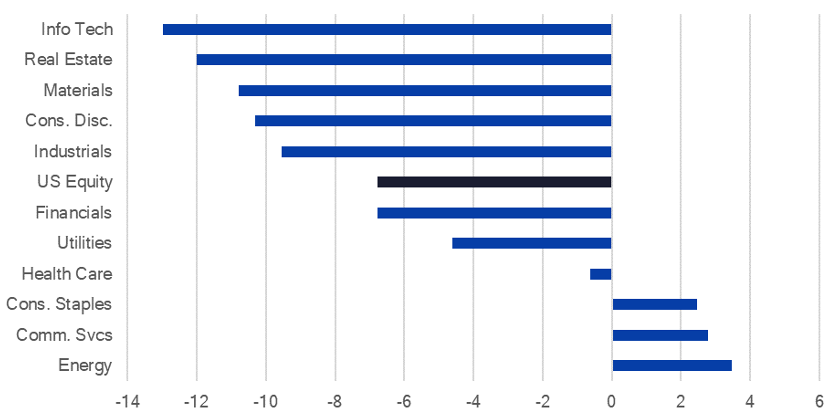

The projected stock-market correction of -6.8% may appear moderate at first glance, but the detailed breakdown in Figure 2 shows much bigger losses in the interest rate-sensitive real estate bucket (-12%) and some of the ‘growth’ sectors, such as information technology (-13%) and consumer discretionary (-10.3%). At the other end of the spectrum are consumer staples (+3.5%) and health care (-0.2%), which are both sectors that are better able to raise prices in times of high inflation. Communication services providers (+2.8%) and utility companies, many of which operate in a regulated environment, are also often able to raise their charges in line with CPI increases. But many gas and electricity providers would also be facing higher input costs — especially those relying on fossil fuels — which would explain the negative overall performance of the utilities sector (-4.6%).

Figure 2. Stimulated returns by equity sector

Source: Axioma Risk

Oil prices are usually highly correlated with breakeven inflation rates — even if the latter are linked to core prices — as energy costs will eventually feed through into most parts of the economy. This is likely behind the 3.5% gain predicted for the energy sector. A surge in fossil fuel prices — for example as a result of a further escalation of current unrest in the Middle East — could well be one reason for those persistent inflationary pressures that might entice the Fed to keep rates at their current levels for yet a while longer.

Be prepared for a rate hike, just in cas

There are many potential sources for more inflation surprises, such as a surge in commodity prices, robust consumer spending, resilient economic growth, or a tight labor market. The minutes from the FOMC meeting on May 1 even revealed that “various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.” A rate hike, which in our view can no longer be ruled out entirely, would lead to yet more severe losses than the ones shown above. Investors should, therefore, prepare for a “higher-for-even-longer” environment by using portfolio stress testing methods like the ones described here.

Visit Axioma Risk to learn more.

“All asset categories in the portfolio are likely to suffer losses—at least at the aggregate level—as would be expected in an environment where investors are concerned about soaring inflation and a more restrictive monetary policy response.”

Related content